Finding innovative ways to tackle rising health care costs for employers, employees, and physicians is top of mind for many — and the topic for a panel of industry experts at the “Focusing on the Future: CEO’s Guide to Restoring the American Dream” forum in Las Colinas, recently.

“Health care cost is the second greatest cost to most employers, right behind payroll,” said Dave Chase, founder of Health Rosetta Institute and keynote speaker at the event at the Four Season’s Hotel.

Panelists shared their own experiences and ways to disrupt the health care payment ecosystem. Ideas on how to create better patient care and outcomes included returning to an old model of patients seeing their primary care physicians before seeking a specialist, building physician/patient relationships, employers encouraging a holistic approach to health and wellness and rewarding employees for taking steps toward that approach, and dismantling-the-fee for service payment model.

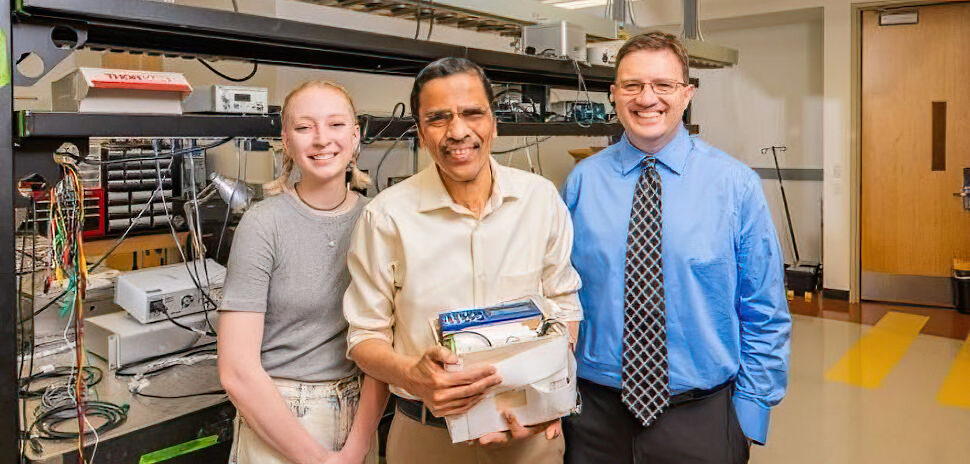

On the panel were: Dr. Christopher Crow, CEO of StratiFi Health and president of Catalyst Health Network; Dr. Martin Sepulveda, former vice president of health for IBM; Scott Miller, president and CEO of Interstate Batteries; and Tom Banning, CEO and executive vice president of Texas Academy of Family Physicians.

FEE-FOR-SERVICE PAYMENT MODEL

The fee-for-service payment model is a method of payment where health care providers are paid by the quantity of services performed, rather than the quality of service performed.

This model incentivizes physicians to provide services that may not be necessary. For employers, it means medical insurance costs continue to balloon each year, which impacts cost for employees. When costs rise for the employee, there’s less incentive to seek preventive care for themselves and families. For middle-class families in the U.S., health-care spending jumped by nearly 25 percent from 2007 to 2014, according to The Wall Street Journal.

“The fact is, employers are spending far more on employees today than they were 20 years ago.”

Dave Chase

“The fact is, employers are spending far more on employees today than they were 20 years ago,” Chase said.

Double-digit increases in cost for health insurance around the turn of the century sparked IBM’s leadership to start discussing ways to reduce the cost to the company.

Sepulveda said he explained to leaders at IBM how changes needed to be less about health insurance costs and more about labor costs and the performance of the employees in the company.

Health care cost is not just what you pay for health insurance, he said. Companies that are driven by human beings must understand that the cost includes: how engaged an employee is while performing their job, are they flexible and agile, do they come to work, are they focused on the work they’re doing?

Having healthy people and healthy families was the way to solve the problem [IBM was facing], Sepulveda said.

CREATING CHANGE

In about 2003-2004, he led an initiative that removed the cost for primary care physician for its employees and families.

“I think culture is critical for us.”

Scott Miller

What happened was, “Healthier employees, healthier families, healthier children, and lower cost,” Sepulveda told Dallas Innovates.

Interstate Batteries has held health-care costs nearly flat for the last five years, Miller said.

“Eighty-eight percent of our folks are earning a wellness contribution,” he added. “I think culture is critical for us.”

Interstate Batteries focuses on whole-person wellness by giving every employee $1,000 each year in their Health Savings Account (HSA), it has a full-time chaplain on site, and the company encourages healthy lifestyles.

EMPLOYERS’ GREATEST ASSET, HEALTHY EMPLOYEES

Over the last several decades, there’s been a shift in the way people seek treatment when they’re sick.

Many people skip seeing a primary care doctor when something goes wrong with their health. Instead, they go straight to a specialist or head to the emergency room. This behavior can lead to more tests, higher costs, and a lack of the opportunity for physicians to know their patients and families on a deeper level.

According to Chase, for every hour of patient visits using the fee-for-service payment model, there are at least two hours of administrative work.

“The traditional employer-based healthcare model is fundamentally flawed –- lack of billing clarity, restriction of consumer choice and inefficient administration all result in physicians being forced to spend more time filing claims than assessing patient needs, employees having less options, and spending less direct time with their primary care physicians, which over time results in more money spent by the employers,” said John Perry, CEO of Accresa, in an email.

Accresa is a payment platform that connects employers, employees, and health providers.

IPA and concierge health-care models encourage patients to first seek care from a primary-care physician, which the panelists say produce better outcomes overall while increasing production and reducing medical costs for employers.

“Healthy employees are the greatest asset any company can have,” Chase said.

Delivering what’s new and next in Dallas-Fort Worth innovation, every day. Get the Dallas Innovates e-newsletter.